The Power of Real-Time Market Data: How Investors Use Information for Better Decisions

In the fast-paced world of finance, timely information is the cornerstone of decision-making. Whether you’re a novice investor or a seasoned financial magnate, the importance of real-time market data cannot be understated. This data, when harnessed effectively, has the power to redefine investment strategies, minimize risks, and maximize returns.

Delving Deeper into the Significance of Real-Time Market Data:

In the intricately interwoven financial fabric of our modern era, every market movement, no matter how small, can exert an outsized influence. A geopolitical event in one country can cause commodity prices to swing worldwide, or an unexpected earnings report from a tech giant might shake the stock market of an entire sector. Understanding and swiftly reacting to these movements can mean the difference between a successful trade and a missed opportunity.

Making Informed Decisions in the Blink of an Eye:

The essence of investing isn’t just about accruing wealth; it’s a continuous process of gathering intelligence, interpreting signals, and making future projections based on real-time information.

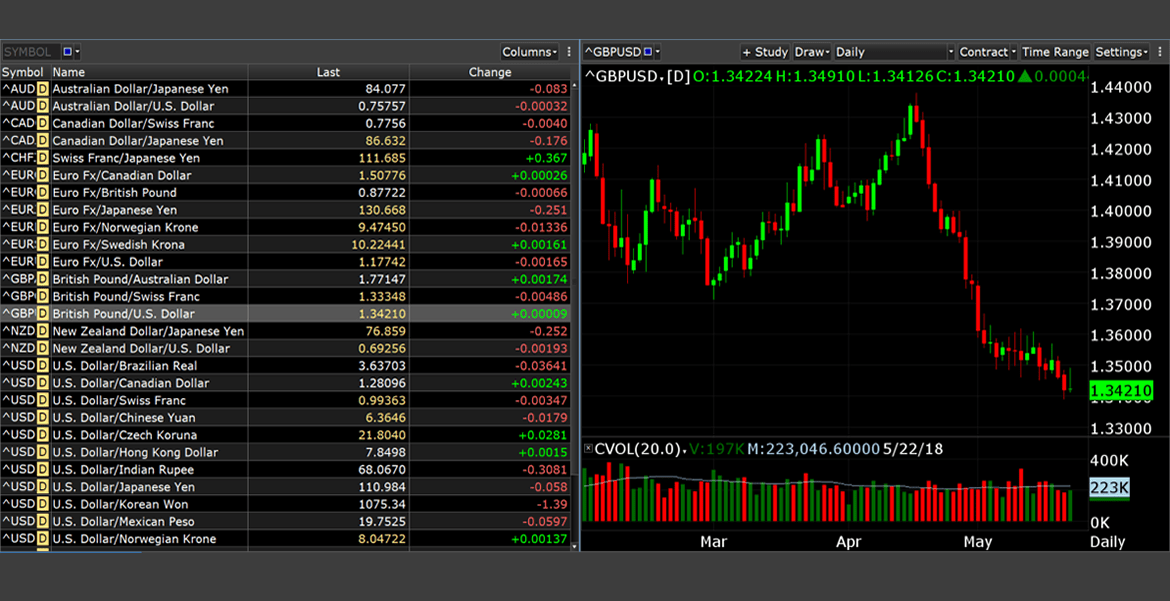

- Immediate Insights: In the ever-shifting sands of the stock market, being privy to live data helps investors get a real-time snapshot. Whether it’s sudden spikes in stock prices, unusual trading volumes, or emerging market trends, real-time data acts as an investor’s eyes and ears.

- Opportunities for Quick Reactions: The financial market is akin to a live organism, ever-evolving and adapting. With real-time data, investors can pivot their strategies on-the-fly. This agility allows them to capitalize on unforeseen market boons and deftly sidestep potential pitfalls.

A Competitive Edge in a Crowded Arena:

In the bustling bazaar of the financial world, where every investor is vying for an edge, real-time data serves as a potent weapon.

- Speed: Particularly in areas like day trading or forex trading, where market positions can change in microseconds, having instantaneous data can mean the difference between profit and loss.

- Accuracy: Outdated information can be the Achilles’ heel of any investment strategy. With real-time data, investors are ensured that their decisions are grounded in the most current market realities, significantly reducing potential risks.

The Technological Pioneers of Real-Time Data Access:

As the clamor for real-time data grows louder, a suite of advanced tools and technologies have risen to the challenge, offering investors unparalleled access to the market’s pulse.

The Transformative Impact of API/Data Solutions:

APIs stand at the intersection of technology and finance, offering an unmatched toolset for real-time data access and integration.

- Seamless Integration: Through APIs, disparate platforms can communicate effortlessly. This means an investor using a specific trading software can tap into real-time data feeds from multiple sources, all integrated into a unified dashboard.

- Customization: Not all data is relevant to every investor. API solutions can be tailored to sieve out the noise and deliver only the most pertinent information, be it specific stock movements, currency rates, or commodity prices.

- Scalability: As an investor’s ambitions and portfolio grow, their data needs expand. APIs are inherently scalable, ensuring that whether you’re managing a thousand or a million assets, the data flow remains smooth and unimpeded.

Mobile and Web Applications: The Market in Your Pocket:

In the age of digitization, the market isn’t confined to trading floors or desktop screens. It’s as ubiquitous as the devices we carry.

- Accessibility: Whether you’re in a cafe in Paris or hiking in the Himalayas, as long as you have a smartphone, the global market is at your fingertips. This omnipresence ensures investment opportunities are never missed.

- Real-time Alerts: With customized push notifications, investors can be alerted of significant market events instantaneously, from drastic price changes to breaking financial news.

- Interactive Dashboards: Modern financial apps are designed not just to provide data but to render it in visually intuitive formats. From graphs charting historical stock performance to heat maps highlighting market hotspots, these apps empower investors to digest complex data sets at a glance.

Harnessing the True Power of Real-Time Market Data:

While the rise of real-time market data has transformed the investing landscape, it’s not the mere possession of this data that’s transformative, it’s how one uses it. Implementing best practices is essential to ensure that the data serves as a catalyst for astute decision-making rather than an overwhelming flood of information.

Continuous Learning and Adaptation: Staying Ahead of the Curve:

The financial universe is in a state of perpetual flux, shaped by geopolitical events, technological innovations, and evolving market dynamics. Investors, therefore, need to be on their toes, continually adapting and expanding their knowledge base.

- Stay Updated: The tools and techniques for market analysis are as dynamic as the markets themselves. Regular participation in workshops, webinars, or courses not only enhances one’s analytical skills but also offers networking opportunities with market experts and fellow investors.

- Test Strategies in Real-time: It’s one thing to theorize a winning investment strategy and another to see it in action. Leveraging real-time data in simulated environments or paper trading platforms allows investors to refine their strategies, understand potential pitfalls, and build confidence before diving into live markets.

Diversify Data Sources: Multiple Lenses for a Clearer Picture:

An over-reliance on a single data source, no matter how comprehensive, can lead to tunnel vision. Diversifying data inputs ensures a 360-degree view of the market and acts as a safeguard against anomalies or inaccuracies.

- Cross-verify Information: Before making pivotal investment moves, cross-referencing data across different real-time sources can provide a more holistic market perspective. This redundancy acts as a safety net, ensuring that decisions aren’t based on outlier data.

- Stay Open to New Platforms: The technological frontier of financial data is always advancing. While loyalty to a platform can be comfortable, it’s essential to remain vigilant about emerging data solutions. Periodic reviews of new platforms can lead to richer data streams and might provide tools better aligned with evolving investment goals.

Incorporating these best practices transforms real-time data from a mere tool into a strategic ally, guiding investors through the ever-shifting labyrinth of the financial world.

Takeaway:

The power of real-time market data is undeniable. In a landscape where timely and accurate information is gold, tools like API/data solutions have revolutionized the way investors access and utilize data. By embracing these technologies and adhering to best practices, investors can navigate the tumultuous seas of the financial markets with confidence and precision, ensuring their investment decisions are not just informed but also impactful.